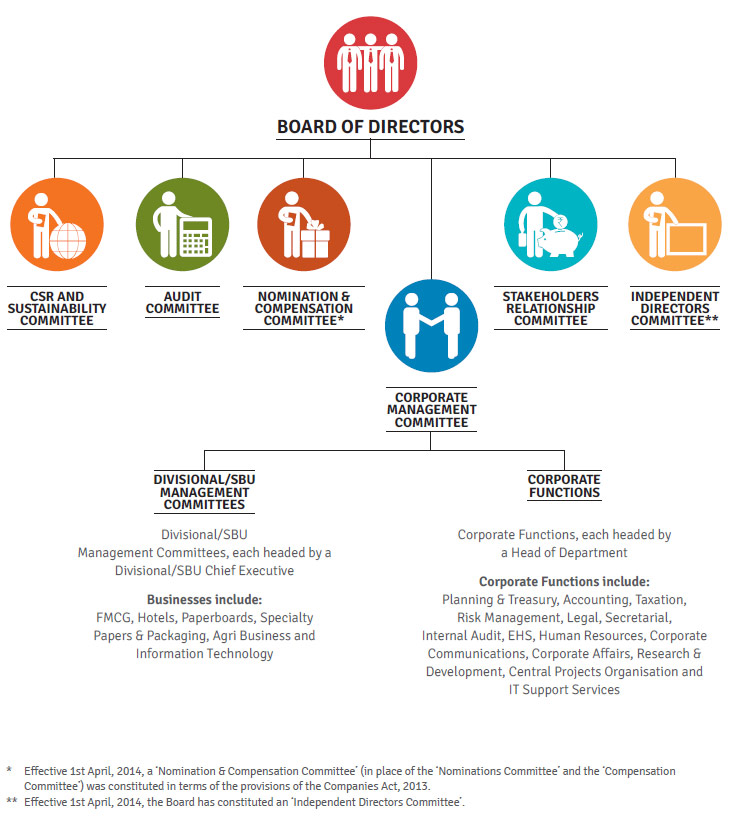

Board Committees

The CSR and Sustainability Committee inter alia, reviews, monitors and provides strategic direction to the Company's CSR and sustainability practices towards fulfilling its Triple Bottom Line objectives.

During the financial year 2013-14, there were five Board Committees – the Audit Committee, the Compensation Committee, the Stakeholders Relationship Committee, the Nominations Committee and the CSR and Sustainability Committee.

AUDIT COMMITTEE

The Audit Committee, as on 31st March, 2014, comprised five Non-Executive Directors, four of whom were Independent Directors. The Chairman of the Committee was an Independent Director. The Executive Director representing the Finance function, the Chief Financial Officer, the Head of Internal Audit and the representative of the Statutory Auditors were Invitees to the Audit Committee. The Head of Internal Audit was the Co-ordinator and the Company Secretary was the Secretary to the Committee. The representatives of the Cost Auditors are invited to meetings of the Audit Committee whenever matters relating to cost audit are considered. All members of the Committee are financially literate; three members, including the Chairman of the Committee, have accounting and financial management expertise.

COMPENSATION COMMITTEE

The Compensation Committee, as on 31st March, 2014, comprised five Non-Executive Directors, four of whom were Independent Directors. The Chairman of the Committee was an Independent Director.

The Compensation Committee, as on 31st March, 2014, comprised five Non-Executive Directors, four of whom were Independent Directors. The Chairman of the Committee was an Independent Director.

STAKEHOLDERS RELATIONSHIP COMMITTEE

The Stakeholders Relationship Committee (earlier known as 'Investor Services Committee'), as on 31st March, 2014, comprised five Directors, three of whom were Independent Directors. The Chairman of the Committee was an Independent Director.

NOMINATIONS COMMITTEE

ITC has constituted a Sustainability Compliance Review Committee, which presently comprises an Executive Director, two members of the Corporate Management Committee and five senior members of management.

The Nominations Committee, as on 31st March, 2014, comprised the Chairman of the Company and eight Non-Executive Directors, seven of whom were Independent Directors.

The Chairman of the Company was the Chairman of the Committee.

CSR AND SUSTAINABILITY COMMITTEE

The CSR and Sustainability Committee (earlier known as 'Sustainability Committee'), as on 31st March, 2014, comprised the Chairman of the Company and three Non-Executive Directors, two of whom are Independent Directors. The Chairman of the Company was the Chairman of the Committee.

The CSR and Sustainability Committee inter alia, reviews, monitors and provides strategic direction to the Company's CSR and sustainability practices towards fulfilling its Triple Bottom Line objectives. The Committee seeks to guide the Company in integrating its social and environmental objectives with its business strategies and assists in crafting unique models to support creation of sustainable livelihoods. The Committee formulates, reviews & monitors the CSR Policy and recommends to the Board the annual CSR Plan of the Company. The Committee also reviews the Business Responsibility Report of the Company.

ITC has clearly defined roles and responsibilities for specific areas that encompass the economic, environment and social dimensions. The Corporate Management Committee of the Company reviews and monitors performance on these dimensions to ensure progress on a continual basis.

The Corporate Management Committee has constituted a Sustainability Compliance Review Committee, which presently comprises an Executive Director, two members of the Corporate Management Committee and five senior members of management. The role of the Committee, inter alia, includes monitoring and evaluating compliance with the Sustainability Policies of the Company and placing a quarterly report thereon for review by the Corporate Management Committee.

The following are the Terms of Reference for the Sustainability Compliance Review Committee :-

- To provide direction on the implementation of ITC's sustainability policies

- To approve appointment of third party assurance provider for sustainability reporting

- To review and approve the Annual Sustainability Report including the materiality matrix

- To facilitate the identification of issues beyond the horizon

- To review the sustainability risk portfolio of ITC and report back on closure by businesses

- To review critical concerns raised by stakeholder and the corrective actions taken, as applicable

- To review progress towards achievement of 50% renewable energy share by 2020 and water security

- To provide guidance on ITC's public disclosures and engagement with external agencies

Chair of the Highest Governance Body

The Compensation Committee, as on 31st March, 2014, comprised five Non-Executive Directors, four of whom were Independent Directors. The Chairman of the Committee was an Independent Director.

The Compensation Committee, as on 31st March, 2014, comprised five Non-Executive Directors, four of whom were Independent Directors. The Chairman of the Committee was an Independent Director.

The Chairman is the Chief Executive of the Company. He is the Chairman of the Board and the CMC. His primary role is to provide leadership to the Board and the CMC for realising Company goals in accordance with the charter approved by the Board.

The Chairman is the Chief Executive of the Company. He is the Chairman of the Board and the CMC. His primary role is to provide leadership to the Board and the CMC for realising Company goals in accordance with the charter approved by the Board.